News

Latest News

Jamie's Air-Fryer Meals: what air fryer does Jamie Oliver use in his recipes?

By Tom Bedford published

We'll help you find the air fryer Jamie Oliver uses in his Channel 4 cooking show Jamie's Air-Fryer Meals.

The next big sport coming to the BBC is… chess!

By David Hollingsworth published

After The Queen's Gambit, chess is cool again and heading to BBC Two

Britain's Got Talent 2024: How to watch season 17 online and on TV now

By Tom Wardley last updated

Gold buzzers at the ready, BGT is back for 2024. Here's how you can watch Britain's Got Talent season 17 online with episodes available now.

Martin Clunes stunned as Brian Cox reveals he's a superfan

By Martin Shore published

Martin Clunes was stunned to learn that Professor Brian Cox was a huge fan of one of his most iconic roles in an appearance on The One Show.

Why is The Rookie not new tonight, April 23?

By Terrell Smith published

The Rookie is not new tonight, April 23. Here's when you can catch the next new episode.

Why is Will Trent not new tonight, April 23?

By Terrell Smith published

Will Trent is not new tonight, April 23. When can fans expect to see the next new episode? Here's everything we know.

General Hospital spoilers: #CarSon and #JaSam, both couples are one crisis away from reuniting?

By Terrell Smith published

Are General Hospital’s Carly and Sonny really over? Are Jason and Sam? Here’s why we think an emergency can unite both couples.

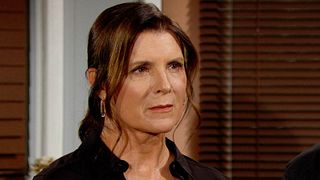

The Bold and the Beautiful spoilers: Sheila framed Sugar?

By Sarabeth Pollock published

Sheila was turning over a new leaf on The Bold and the Beautiful, so was she framed by Sugar or was it the other way around?

Get the What to Watch Newsletter

The latest updates, reviews and unmissable series to watch and more!