AT&T TV Now subscribers and earnings

The question is whether the launch of HBO Max on May 27 can do anything about it

Q1 2020 | Q4 2019 | Q3 2019 | Q2 2019 | Q1 2019

Q1 2020 (April 22, 2020): HBO Max cometh

AT&T has released its earnings for the first quarter of 2020. Here's what you need to know:

- AT&T TV Now (the former DirecTV Now and AT&T's pure OTT streaming play) now has 788,000 subscribers. That's down nearly 48 percent from Q1 2019.

- And that's down from about 926,000 at the end of Q4 2019 — a loss of 138,000 subscribers.

- AT&T's other "premium TV" offerings are down nearly 17 percent year over year, and the net losses were up to nearly 65 percent year over year.

- HBO Max will launch on May 27.

Q4 2019 (Jan. 29, 2020): Get ready for HBO Max

AT&T today announced its earnings for the fourth quarter of 2019. Here's what you need to know:

- AT&T TV Now — formerly known as DirecTV Now — had a net loss of 219,000 subscribers for the quarter.

- That should take it down to around 926,000 subscribers in total.

- HBO Max is still on track to launch in May 2020.

- More than 10 million current HBO subscribers will be immediately offered HBO Max.

- Look for AT&T to leverage its upcoming 5G network to distribute HBO Max.

- AT&T says that it's in discussion with potential distribution partners, including MVPDs. (That means other services like YouTube TV, Hulu and Sling.)

- HBO Max also will be bundled with other AT&T-owned services, like mobile and broadband.

- Going forward, AT&T's video strategy will focus on AT&T TV (not AT&T TV Now) and HBO Max.

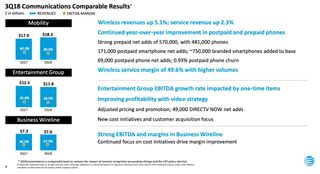

Q3 2019 (Oct. 28, 2019): Down to 1.1 million subscribers

AT&T on Oct. 28, 2019, announced its earninigs for the third quarter of the year. Here's what you need to know:

- AT&T TV Now — the former DirecTV Now — lost a net 195,000 subscribers in the three months ending Sept. 30.

- AT&T says that's because of "higher prices and less promotional activity."

- There are now 1.1 million AT&T TV Now subscribers.

- HBO Max is still coming — and AT&T will be giving more details at an investor event on Oct. 29.

Q2 2019 (July 24, 2019)

AT&T has announced its earnings for the second quarter of 2019. Here's what you need to know:

- DirecTV Now lost 168,000 net subscribers in Q2

- That should leave them with about 1.33 million subscribers

- And if estimates are correct, that means DirecTV Now has slipped to the fourth-largest streaming service in the U.S.

- AT&T TV — the skinny bundle with its own hardware — is slated to launch in test markets in Q3

- HBO Max is slated to launch in the spring of 2020

Q1 2019 (April 24, 3019): The hits, they keep on coming

AT&T has released its earnings for the first quarter of 2019. DirecTV Now still falls under the Entertainment Group. And as we expected, it was a rough quarter. Here's what you need to know:

- DirecTV Now lost 83,000 net subscribers for the quarter. That's way down from its Q4 2018 losses — about 69 percent less.

- That's due to price increases, the company says, plus fewer promotions.

- But ... the average revenue per user for DirecTV Now is now greater than $10.

- DirecTV Now now has a total of 1.5 million subscribers. That should keep it in the No. 2 spot .

- AT&T doesn't exact to lose as many in the second quarter, and says it should have a "decent" second half of the year.

- The Entertainment Group brought in $11.3 billion, down 0.9 percent year over year "due to declines in TV subscribers and legacy services."

- Total video subscribers were down by 627,000

- Premium TV subscribers lost 544,000 "due to an increase in customers rolling off promotional discounts, competition and lower gross adds due to a focus on long-term value customer base."

AT&T will announce its Q2 2019 earnings on July 24, 2019.

Get the What to Watch Newsletter

The latest updates, reviews and unmissable series to watch and more!

Q4 2018 (Jan. 30, 2019): Easy come, easy go

AT&T has released its Q4 2018 earnings for the company. DirecTV Now falls under the Entertainment Group. Here's what you need to know:

- DirecTV Now lost 267,000 subscribers for the quarter.

- That takes DirecTV Now down to about 1.57 million subscribers overall.

- "Traditional" video was hit even harder, losing 391,000 subs.

- The company attributes that to a scaling back of promotional prices and says no customers are on those discounted plans.

- Fewer customers are on entry-level plans, but higher tiers remained stable.

- More than a half-million accounts are on the WatchTV skinny bundle.

AT&T's Q1 2019 earnings will be released on April 24.

Q3 2018 (Oct. 24, 2018): DirecTV Now is up, video overall is down

AT&T announced its third-quarter earnings, which means we get a glimpse into the numbers behind a whole lot of things. But for our purposes here, it's DirecTV Now that we're really interested in.

Here's what you need to know:

- DirecTV Now saw 49,000 net additions in the third quarter.

- That should take its total subs to about 1.84 million subscribers.

- AT&T's entertainment group still saw a net loss of 346,000 "traditional video" subscribers. The satellite arm of DirecTV certain makes up a big chunk of that.

- AT&T confirms that it's beginning to "beta test a new streaming video device."

- That new device has been known since the spring , but exactly what it will be — and why you'd want a box from AT&T instead of, say, Amazon or Roku — remains to be seen.

Q2 2018 (July 24, 2018): Enter the Entertainment Group

AT&T today announced its earnings for the second quarter of 2018 . And as you'd expect, streaming video is having a pretty big impact on the bottom line.

Here are the big strokes, of interest to cord-cutters:

- AT&T's Entertainment Group — of which DirecTV Now is a part — saw 342,000 net additions in the second quarter

- That gives DirecTV Now a total of 1.8 million subscribers (up from 1.5 million in Q1)

- But total video subscribers were up by just 80,000 for the quarter

- DirecTV satellite subscribers continue to switch elsewhere, losing 286,000 customers

The delivery mechanisms are just a few parts of what AT&T is doing today, though, particularly after AT&T's purchase of Time Warner in Q2. Look for more original programming from the newly formed Warner Media properties, and new features (and new revenue streams) from all of AT&T's assets.